What is Smart Money Concept? Understanding Market Movers

AndyVentura • 5/21/2025, 6:16:07 PM

The Smart Money Concept is a powerful framework used by traders and investors to understand how the most influential market participants—often called “smart money”—operate in financial markets. This concept revolves around the idea that institutional investors, hedge funds, and other large players have access to superior information, resources, and strategies, which allow them to anticipate market moves before they become obvious to the average trader.

Defining Smart Money

Smart money refers to capital controlled by professional investors, institutions, and market insiders who are believed to have a better understanding of market dynamics. Unlike retail traders, these participants typically have access to advanced analytical tools, proprietary research, and significant market influence due to the size of their trades.

The Smart Money Concept suggests that by observing the behavior of these market movers, retail traders can gain insights into potential price movements and market trends. Essentially, if you can identify where smart money is flowing, you can align your trades with the prevailing market direction.

Origins and Importance of the Concept

The idea of tracking smart money is not new. It has roots in fundamental and technical analysis, where traders look for signs of institutional accumulation or distribution. Over time, this evolved into a more structured approach, especially with the rise of algorithmic trading and data analytics.

Understanding where smart money is investing helps traders avoid common pitfalls such as chasing false breakouts or getting caught in market manipulations. It also aids in spotting early trends and reversals, increasing the probability of successful trades.

Key Principles of the Smart Money Concept

-

Market Makers and Institutional Influence: Market makers and institutions often drive price action. They accumulate positions quietly before large moves and distribute them at optimal levels. Recognizing these accumulation and distribution phases is crucial.

-

Volume and Price Patterns: Smart money tends to leave traces in volume spikes and price action anomalies. For example, a sudden increase in volume without significant price movement might indicate accumulation.

-

Liquidity Pools: Smart money targets areas with high liquidity to execute large orders without causing excessive price disruption. These areas often correspond to support and resistance levels, stop-loss zones, or previous highs and lows.

-

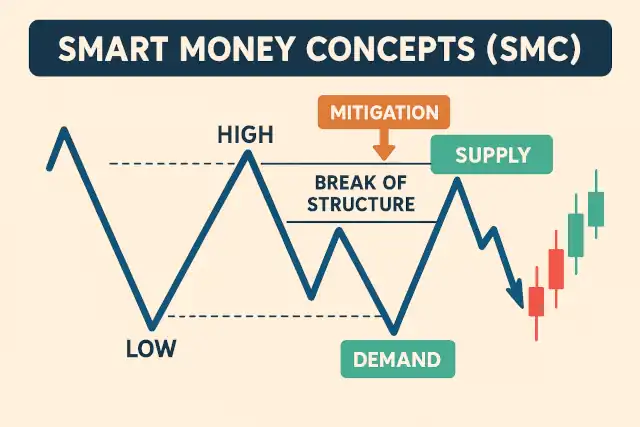

Market Structure: Observing changes in market structure—such as break of market structure (BMS), higher highs, or lower lows—can provide clues about smart money intentions.

How to Identify Smart Money Activity

1. Volume Analysis

Volume is a critical indicator when tracking smart money. An increase in volume during a price rally or decline often indicates institutional participation. However, not all volume spikes are created equal; smart money volume tends to be sustained and occurs at strategic price levels.

2. Order Flow and Footprint Charts

Advanced traders use order flow data and footprint charts to see real-time buying and selling pressure. These tools reveal where large orders are being placed and executed, highlighting smart money activity.

3. Price Action and Candlestick Patterns

Certain candlestick patterns, such as pin bars or engulfing candles near key support or resistance, can signal smart money presence. These patterns often indicate rejection of price levels or strong directional intent.

4. Commitment of Traders (COT) Reports

The COT report, published weekly by the Commodity Futures Trading Commission (CFTC), shows the positioning of large traders in futures markets. Analyzing this report helps traders gauge smart money sentiment.

Smart Money Concept in Algorithmic Trading

With the rise of algorithmic trading, smart money has become more sophisticated. Algorithms can detect patterns and execute trades faster than humans, making it essential for retail traders to use technology to keep up.

Algorithmic trading platforms often integrate smart money indicators to help users identify institutional activity. These platforms analyze large datasets, including volume, order flow, and price action, to generate signals aligned with smart money behavior.

Practical Applications for Traders

-

Trend Identification: By following smart money flows, traders can identify emerging trends early and enter positions with higher confidence.

-

Risk Management: Understanding smart money activity helps in setting more effective stop-loss levels and avoiding false breakouts.

-

Trade Timing: Smart money analysis can improve entry and exit timing by revealing when institutions are accumulating or distributing positions.

-

Market Sentiment: Tracking smart money can serve as a proxy for overall market sentiment, guiding traders on when to be bullish or bearish.

Common Smart Money Indicators

-

Volume Weighted Average Price (VWAP): VWAP shows the average price weighted by volume and is often used by institutions to evaluate trade execution.

-

Accumulation/Distribution Line: This indicator measures the cumulative flow of volume and price to assess whether an asset is being accumulated or distributed.

-

On-Balance Volume (OBV): OBV adds volume on up days and subtracts on down days, helping to confirm price trends.

-

Price and Volume Trend (PVT): PVT combines price and volume to detect buying and selling pressure.

Limitations and Challenges

While the Smart Money Concept is valuable, it is not foolproof. Market dynamics are complex, and smart money can sometimes misinterpret information or be caught off guard by unexpected events. Additionally, retail traders may struggle to access the same level of data or interpret signals correctly without sufficient experience.

False signals and noise are common, so it’s essential to combine smart money analysis with other technical and fundamental tools. Discipline, patience, and continuous learning are key to effectively applying this concept.

Conclusion

The Smart Money Concept offers a compelling way to understand market movements by focusing on the behavior of the most influential participants. By learning to identify smart money activity, traders can enhance their strategies, improve timing, and manage risks more effectively.

Whether you are a beginner or an experienced trader, incorporating smart money principles into your trading toolkit can provide a significant edge. Leveraging technology, data analysis, and market insights will help you align your trades with the true market movers and increase your chances of success.