wyckoff distribution

AndyVentura • 5/8/2025, 10:54:58 PM

Understanding Wyckoff Distribution: A Key Concept in Algorithmic Trading

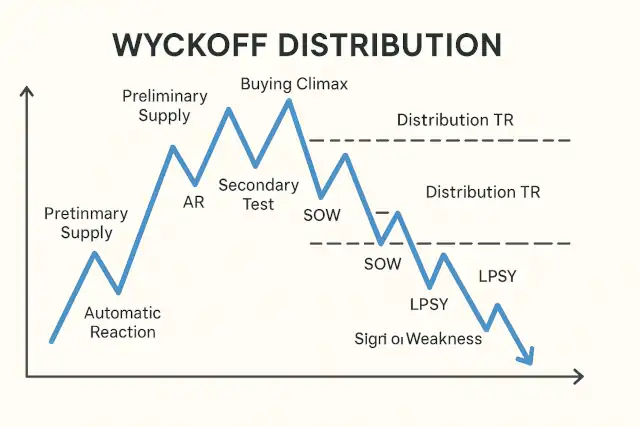

The Wyckoff Distribution is a fundamental concept in technical analysis and algorithmic trading, used to identify potential market tops and anticipate significant price declines. Developed by Richard D. Wyckoff in the early 20th century, the Wyckoff Method provides traders with a systematic approach to reading price action and volume to forecast market behavior.

What is Wyckoff Distribution?

Wyckoff Distribution refers to a phase in the market cycle where large institutional traders and smart money begin to unload or “distribute” their holdings to retail traders and the general public. This phase typically occurs after a prolonged uptrend and signals a potential reversal or a major correction.

In simple terms, during distribution, the price appears to be consolidating near its highs, but large players are quietly selling off their positions without triggering panic among smaller investors. Recognizing this pattern early can help traders position themselves to avoid losses or even profit from the impending downturn.

The Structure of Wyckoff Distribution

Wyckoff Distribution is characterized by several distinct phases and price actions. Understanding these helps algorithmic trading systems identify potential sell signals.

1. Preliminary Supply (PSY)

This phase marks the first signs of selling pressure after an uptrend. Volume increases as smart money starts to sell, but the price continues to rise or trade sideways.

2. Buying Climax (BC)

The buying climax is the point where aggressive buying reaches its peak, often accompanied by high volume and a sharp price increase. This is typically followed by increased volatility.

3. Automatic Reaction (AR)

After the buying climax, the price reacts with a sharp decline due to the sudden increase in supply. This reaction helps establish the upper and lower boundaries of the trading range.

4. Secondary Test (ST)

The price revisits the area near the buying climax to test supply levels. Volume and price behavior during this test provide clues about the strength of the distribution.

5. Sign of Weakness (SOW)

This phase shows a clear breakdown from the trading range with increased volume and declining price, indicating that sellers have taken control.

6. Last Point of Supply (LPSY)

After the sign of weakness, the price may rally slightly, but it fails to reach previous highs, forming lower highs and signaling the exhaustion of buyers.

7. Breakdown

Eventually, the price breaks below the trading range support, confirming that distribution is complete and a downtrend may begin.

Applying Wyckoff Distribution in Algorithmic Trading

Algorithmic trading strategies can be designed to detect the Wyckoff Distribution phases by analyzing price patterns, volume spikes, and volatility changes. Key indicators include:

- Volume analysis to detect increased supply

- Price action to identify trading range boundaries

- Momentum indicators to confirm weakness

By programming algorithms to recognize these signals, traders can automate entry and exit points, minimizing emotional bias and improving trade timing.

Conclusion

The Wyckoff Distribution phase is a critical concept for traders aiming to anticipate market reversals and capitalize on price declines. Understanding its phases and characteristics enables both manual and algorithmic traders to make informed decisions, manage risk, and enhance profitability. Incorporating Wyckoff principles into trading algorithms can provide a systematic edge in navigating complex market cycles.

For those interested in algorithmic trading, mastering the Wyckoff Distribution is an essential step toward building robust and adaptive trading systems.