Understanding the VWAP Indicator: A Key Tool for Algorithmic Trading

AndyVentura • 5/10/2025, 2:28:42 AM

Understanding the VWAP Indicator: A Key Tool for Algorithmic Trading

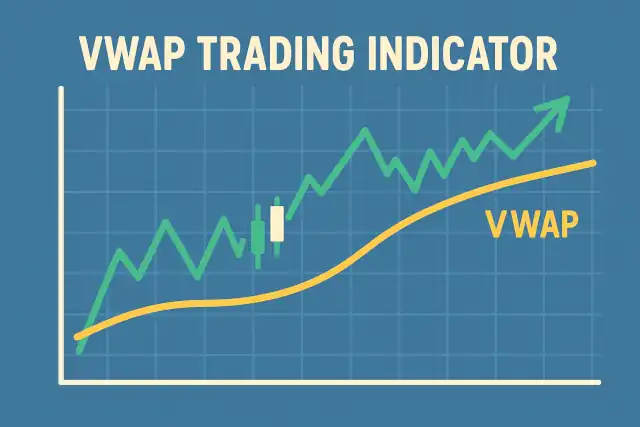

In the world of algorithmic trading, having reliable and insightful technical indicators is crucial for making informed decisions. One such indicator that has gained immense popularity among traders and institutions alike is the Volume Weighted Average Price (VWAP). This article explores what the VWAP indicator is, how it is calculated, its significance in trading, and practical ways to incorporate it into your algorithmic trading strategies.

What is the VWAP Indicator?

The Volume Weighted Average Price (VWAP) is a trading benchmark that represents the average price a security has traded at throughout the day, weighted by volume. Unlike simple moving averages, which give equal weight to all prices, VWAP assigns greater importance to prices at which higher volumes were traded. This makes VWAP a more accurate reflection of the true average price traders paid during the day.

VWAP is commonly used by institutional investors and algorithmic traders to gauge market sentiment and to execute trades in a way that minimizes market impact.

How is VWAP Calculated?

The VWAP calculation involves a cumulative process that updates as new trades occur during the trading session. The formula is:

Where:

- = Price of the trade at time

- = Volume of the trade at time

- = Current time or trade index within the trading day

In practical terms, at each new trade, you multiply the trade price by its volume, add this to the cumulative total, and then divide by the total volume traded so far in the day. Because VWAP resets at the start of each trading session, it is primarily an intraday indicator.

Why is VWAP Important?

1. Benchmark for Trade Execution

Institutional traders often use VWAP as a benchmark to measure the quality of their trade executions. Buying below the VWAP or selling above it is generally viewed as favorable because it implies the trader achieved better prices than the average market participant.

2. Identifying Market Sentiment

When the price is consistently above the VWAP, it suggests bullish sentiment, as buyers are willing to pay more than the average price. Conversely, prices below the VWAP can indicate bearish sentiment.

3. Support and Resistance Levels

VWAP can act as a dynamic support or resistance level during the trading day. Prices often gravitate toward the VWAP line, and traders watch for price reactions around this level to make trading decisions.

4. Reducing Market Impact

Algorithmic trading strategies use VWAP to minimize market impact by slicing large orders into smaller chunks executed at prices close to or better than the VWAP.

How to Use VWAP in Algorithmic Trading Strategies

VWAP as a Trend Filter

Many algorithmic strategies use VWAP as a trend filter. For example, a strategy might only take long positions when the price is above the VWAP, indicating upward momentum, and short positions when the price is below the VWAP.

VWAP Crossovers

Similar to moving average crossovers, some traders use the price crossing the VWAP as a signal. A price crossing above the VWAP might trigger buy signals, while crossing below could trigger sell signals.

VWAP and Volume Confirmation

Since VWAP incorporates volume, combining it with volume-based indicators can provide stronger trade signals. For instance, a breakout above the VWAP confirmed by increasing volume can indicate a more sustainable move.

VWAP for Order Execution Algorithms

Execution algorithms like VWAP algorithms aim to execute trades at prices close to the VWAP, minimizing slippage and reducing market impact. These algorithms adjust the trade size and timing dynamically throughout the trading session.

Limitations of VWAP

While VWAP is a powerful indicator, it has some limitations:

- Intraday Use Only: VWAP resets daily, so it is not useful for longer-term trend analysis.

- Lagging Indicator: Because it is cumulative, VWAP can lag price movements, especially early in the trading session.

- Volume Dependency: During low volume periods, VWAP may be less reliable.

Best Practices for Using VWAP

- Combine VWAP with other technical indicators (e.g., RSI, MACD) for confirmation.

- Use VWAP in conjunction with volume analysis to enhance signal reliability.

- Avoid relying solely on VWAP for trade decisions; consider broader market context.

- Adjust algorithm parameters based on the asset’s liquidity and volatility.

Example: Implementing VWAP in a Trading Algorithm

Below is a simplified example of how VWAP can be integrated into an algorithmic trading strategy:

- Calculate VWAP continuously during the trading day.

- Generate Signal: If the current price crosses above the VWAP, generate a buy signal; if it crosses below, generate a sell signal.

- Confirm Signal: Check if the volume is above average to confirm the signal.

- Execute Trade: Submit orders accordingly, possibly using a VWAP execution algorithm to minimize impact.

This approach helps traders align their trades with intraday market trends and volume dynamics.

Conclusion

The Volume Weighted Average Price (VWAP) is an indispensable indicator for algorithmic traders and institutional investors. By providing a volume-adjusted average price, it offers a more nuanced view of market trends than simple price averages. VWAP’s ability to act as a benchmark, trend filter, and execution guide makes it a versatile tool in the trader’s arsenal.

When incorporated thoughtfully into algorithmic trading strategies, VWAP can improve trade execution quality and help identify profitable trading opportunities. However, like all indicators, it is most effective when combined with other tools and sound risk management practices.

Understanding and mastering VWAP can give algorithmic traders a significant edge in today’s fast-paced markets.